Navigating the world of debts can be a complex task. This extensive guide aims to shed light on the intricacies of controlling your loans. From pinpointing different types of borrowing to adopting effective approaches for repayment, we'll examine the Debet essential principles that support you to master your monetary situation.

- We'll begin by explaining what constitutes a loan.

- Following this, we'll analyze the various forms of financial obligations.

- Moreover, we'll touch upon strategies for establishing a sound amortization schedule.

Bear with us that understanding money is an continuous process. This guide provides a solid foundation for your path toward financial independence.

Entry and Its Role in Financial Accounting

Debit coupled with credit are the fundamental principles underlying double-entry bookkeeping, a system that forms the bedrock of financial accounting. A debit represents an increase in assets or expenses whereas a decrease in liabilities, equity, or revenues. Conversely, a credit signifies an increase in liabilities, equity, or revenues while a decrease in assets or expenses. These contrasting entries ensure that the accounting equation (Assets = Liabilities + Equity) always remains balanced.

- Illustratively, if a company purchases equipment using cash, the debit entry increases the value of the equipment asset, concurrently the credit entry reduces the cash asset.

- Each transaction is recorded with a corresponding debit and credit, providing a complete illustration of the financial effects.

By meticulously recording debits and credits, businesses can track their state over time, identify trends, and make informed choices.

Understanding Debits: The Art of Accurate Transaction Recording

Accurate bookkeeping hinges on a firm grasp of credit mechanics. A charge signifies an addition to an asset, expense, or dividend account, while a decrease represents a reduction in these entries. Mastering this fundamental principle allows for the establishment of balanced financial statements, providing a clear picture of your financial health. To achieve this accuracy, it's crucial to thoroughly record each transaction, following the golden rule of double-entry bookkeeping.

- Individual transaction requires at least two entries: a increase and a corresponding credit to maintain parity.

Debating : Tips for Success

Embarking on the quest of mastering argumentation can be both rewarding. To thrive in this arena, consider these essential tips. Firstly, sharpen your inquiry skills to compile a thorough understanding of the topic at hand. Organize your arguments coherently, delivering them with clarity.

- Engage with your opponents courteously, considering their perspectives.

- Rehearse your delivery to ensure assurance. Attend attentively to your counterparts, evaluating their arguments critically.

{Ultimately|, In the end, or Finally], success in disputation arises from a combination of knowledge, logic, and communication.

Debit Errors: Spotting and Fixing Typical Problems

When it comes to financial transactions, even the smallest mistake can cause a big issue. Frequent culprit is debit errors. These occur when a sum of money is taken out incorrectly, leaving you in a sticky situation. Identifying and correcting these errors promptly is crucial to avoiding further financial difficulties.

Firstly understanding the varieties of debit errors. These can include unapproved purchases, incorrect withdrawal figures, and billing errors. Find these problems, it's crucial to check your bank statements carefully.

- Check for any purchases you don't recognize

- Match your expenses with your account activity

- Double-check the totals of each debit

Spotted a potential error, it's important to take action. Reach out to your bank or financial institution immediately and report the problem. Be prepared to submit relevant information such as your account number and any proof of purchase that you may have.

Remember that prompt action is key to resolving debit errors quickly and efficiently. By being attentive, you can minimize the impact of these errors and ensure your financial stability.

Unveiling Insights from Financial Statements

Debet analysis is a vital tool for understanding the financial health and performance of businesses. By meticulously examining the various debets and credits in financial statements, analysts can uncover valuable insights into a company's profitability, liquidity, solvency, and overall operational efficiency. Through thorough debet analysis, stakeholders can gain a deeper understanding of financial trends, enabling them to make more informed decisions.

A fundamental aspect of debet analysis involves comparing historical financial data with industry benchmarks and current performance metrics. This comparative approach allows analysts to identify areas of strength and weakness, pointing out opportunities for improvement and potential risks.

By undertaking a detailed debet analysis, stakeholders can {gaina multifaceted understanding of a company's financial position, enabling them to make well-informed decisions that contribute to sustainable growth and profitability.

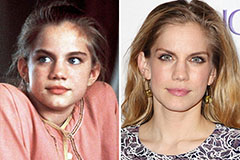

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!